tl;dr:

if you are a sole trader or business owner who was paying through the nose for your electricity bills last year, you can apply for a reimbusement from Skatteverket - https://www7.skatteverket.se/portal/stod

It’s a pretty easy process but you only have until 2023-09-25 to get it done. If you just want the walkthrough, skip ahead to “Application process”.

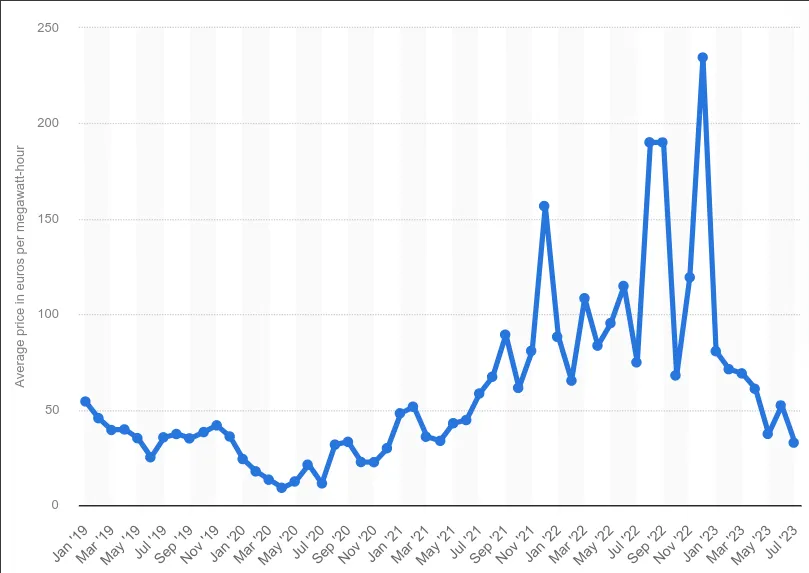

Background - the energy price explosion

As anyone who runs a business in Sweden is likely aware, energy prices went through the roof during the COVID-19 era. From a low of SEK98 (approximately EUR9) in March 2020 when intra-Sweden community transmission was first officially reported, the average energy wholesale price peaked at SEK2579 (approximately EUR234) in November 2022 - an astonishing 2600% increase.

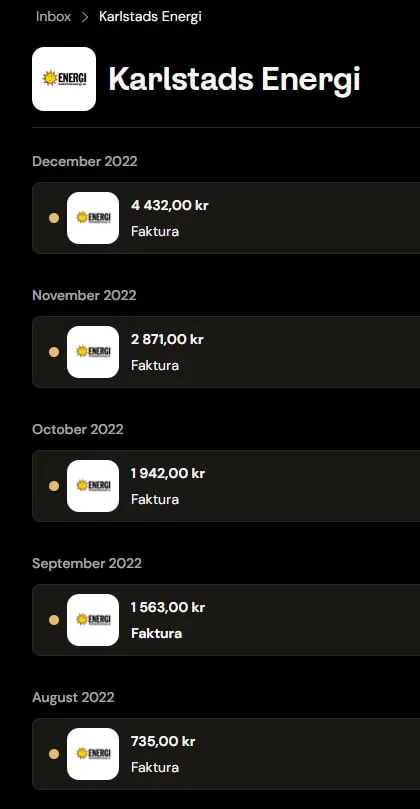

As a more concrete example, during November and December of 2022 I was packing everything up and moving things into storage. Keeping in mind that the main power consumers (several fairly heavy servers running 24x7) were shut down in November, it was hard to swallow when GrailForge’s energy bill went up roughly 5x in the last 4 months of 2022.

Försäkringskassan already provided some form of electricity support (“elstöd”) to private elecricity customers earlier in 2023 but I didn’t hear anything about such support for businesses until I stumbled upon it by accident while reading up about something required for GrailForge’s annual reports. It turns out Skatteverket also has an elstöd offering for businesses (including sole traders).

Eligibility

As best as I could determine from the web site and a phone call with Skatteverket, businesses can apply for the elstöd payment subject to the following requirements:

- you had an electricity network agreement (elnätsavtal) on 2022-11-17

- the energy consumption for the business operations took place in energy area (“elområde”) 3 or 4 (more on this below)

- the energy was consumed between 2021-10-01 to 2022-09-30

- you didn’t receive any elstöd payment from Försäkringskassan for the same period

- you are registered for F-tax

- you have no outstanding tax debts

- you are not in liquidation or bankrupt

- your energy contract (“elavtal”) was not on a fixed-price agreement

The payment is calculated based on yourelectricity consumption between 2021-10-01 to 2022-09-30. Why that doesn’t cover up to November when the eligibility cut-off applies is a mystery but hey, better than nothing right?

The reimbursement rate is as follows:

- SEK 0.79 per kilowatt-hour for businesses in energy area 4

- SEK 0.50 per kilowatt-hour for businesses in energy area 3

If you aren’t sure which price area you are in, it doesn’t hurt to apply. It will clarify your area for you during the application process.

It gets more complicated if your company is under a holding company or otherwise part of a collective of companies which all need to apply for the reimbusement together through a representative agent. I didn’t read into this too far since it didn’t apply to me and the odds are if you’re big enough to need that your accountant should probably have this covered for you already.

Application process

If your svenska is still DuoLingo level and you’re not comfortable navigating Skatteverket forms, the following is a brief summary of how I went through it. The entire process took less than 5 minutes and I received a confirmation letter through Kivra confirming my payment the next day.

Disclaimer

This is ABSOLUTELY NOT an official guide of any kind. You assume all responsibility for how you complete your application.

-

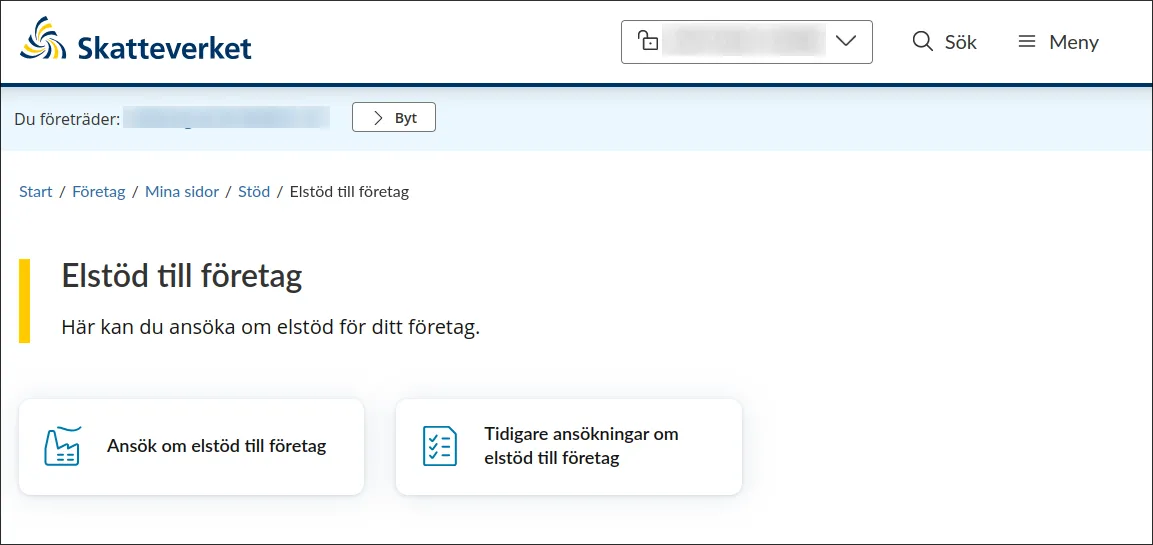

Visit https://www7.skatteverket.se/portal/stod/ and sign in (if you don’t know how to sign in to Skatteverket and are conducting business in Sweden you have bigger problems than electriity payments).

-

You should see something like in the following screenshot. Choose “Ansök elstöd till företag” from the two options presented.

Section 1 - qualifying questions

-

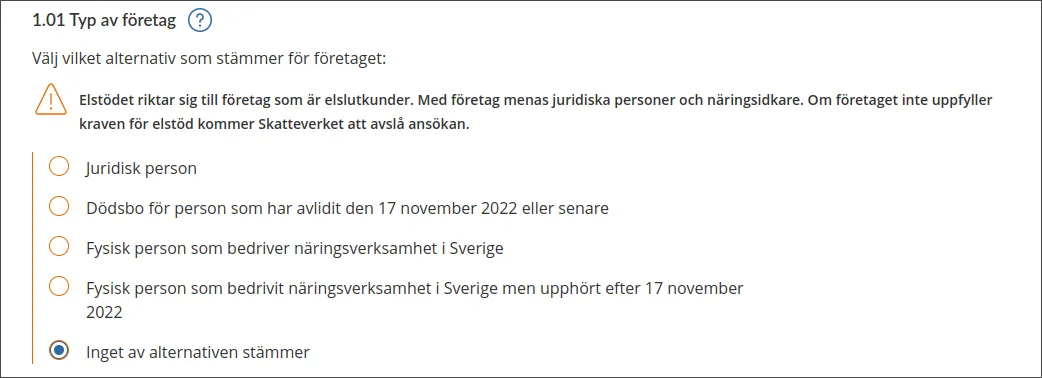

1.01 - Type of company

If you have an aktiebolag (“AB”) limited company or similar, choose “Juridisk person”. If you are a sole trader choose one of the “Fysisk person” options (the second ‘fysisk person’ option is if you ceased trading after 2022-11-17).

-

1.02 - are you the end customer for electricity (not reseller etc) Unless you’re an electricity reseller or similar, I imagine most would choose ‘yes’.

-

1.03 Fixed price agreement?

-

1.04: are you a credit institure, securities company or authority?

-

1.06: any debts with Kronofogden

-

1.07: are you in liquidation

-

1.08: are you bankrupt

-

1.09: have you previously received aid which the European Commision ruled as illegal and you needed to repay

-

1.10: are there any EU sanctions against you? (Sorry Putin, no elstöd for you)

Click the yellow “Nästa” button to continue.

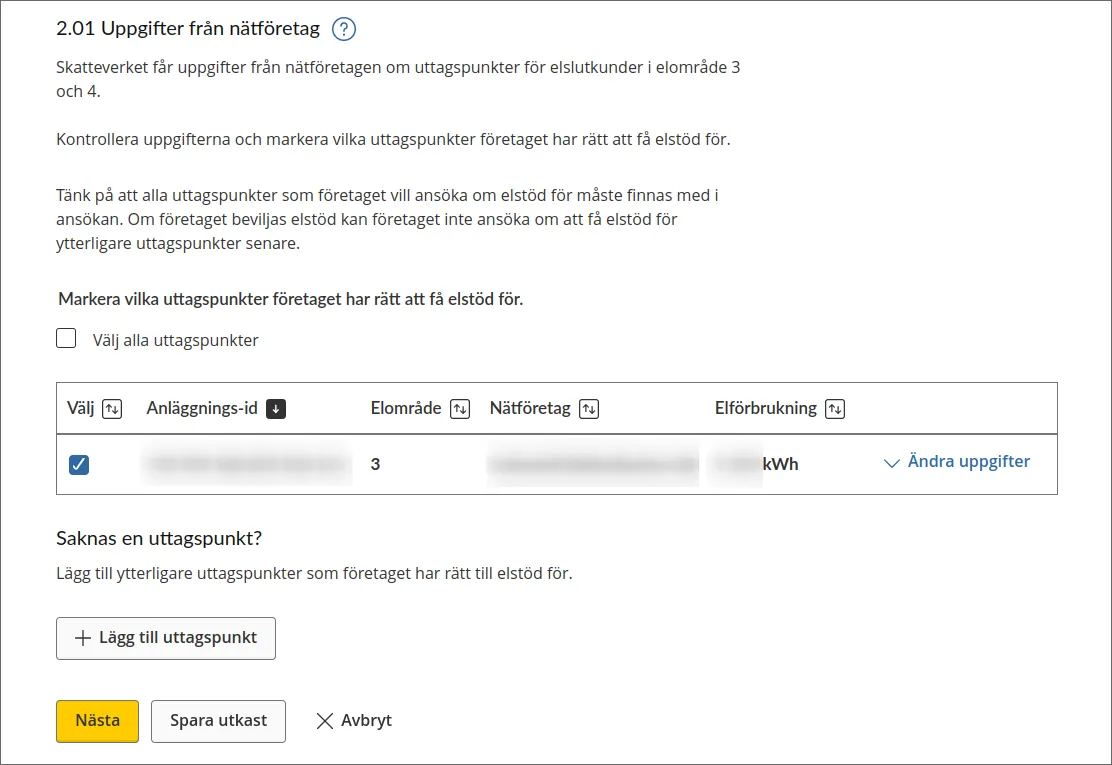

Section 2 - connection points

In most cases this should be automatically filled for you. Mine was simple with only one entry. You may have more if, for example, you changed energy providers or you have multiple fixed places of business with separate energy connection points.

This is also an opportunity to double-check that your business falls within energy area 3 or 4 as indicated by the “Elområde” column.

Click “Nästa” to continue.

Sections 3 to 6 - quick ones

I was able to basically skip these but if you think they apply to you then it might be a good idea to get some proper advice.

-

3: is the company in any interest group, e.g. under an umbrella company or otherwise part of a group fo companies

-

4: are you in primary production (agriculture, fisheries)

-

5 - this was empty for me, so just clicked “Nästa”

-

6 - show me the money! This section will give you an estimated payment. I just copied the value they provided into the prompt and clicked “Nästa”,

-

7 - was also empty

-

8 - provide your contact details.

Section 9 - final confirmation

- double-check the details to make sure everything looks correct.

- tick “Jag försäkrar på heder och samvete att uppgifterna i ansökan är riktiga och fullständiga” to testify that you’ve answered everything honestly

- click “Lamna in ansokan” to submit your application

… and you’re done!

But remember - you only have until Monday 2023-Sep-25 to apply.